Krasimir Petkov

ORCID iD: 0009-0005-5356-9182

University of National and World Economy – Sofia, Bulgaria

https://doi.org/10.53656/igc-2024.14

Pages 207-219

Abstract. The paper develops an artificial intelligence-driven framework that provides an enhanced approach to both pre- and post-money valuations of equity crowdfunding companies. The study integrates generative AI with DCF and CAPM models and thus enables the assessment of a comparative analysis between the initial pre-money and the post-campaign valuation of equity crowdfunded business ventures. The research results in a pilot case study testing the suggested logical framework method which points toward the differences in this respect, showcasing the potential for AI in enhancing investors’ capacity to make better decisions.

Keywords: Equity Crowdfunding; Company Valuation; AI in Finance; CAPM, DCF/FCFE

JEL: G32, G24, C63

- Introduction

Equity crowdfunding (ECF) is a method in which individuals can invest in private companies in exchange for equity, or shares, in those companies[1]. It is defined as a financial service ensuring the matching of business funding interests of investors and project owners through the use of a crowdfunding platform (European Parliament & Council of the European Union, 2020).

While there are numerous reasons for an investor to buy a stake in an equity-crowdfunded company, among which the potential for high returns, the opportunity to drive positive changes, the possibility to impact and influence a business or just to diversify one’s investment portfolio, the list of the associated risks with such an investment can even be longer. Given the nature of equity crowdfunded companies (mostly envisioned as start-ups) and the immense levels of risk their projects involve, such as low cash flows, few tangible assets to serve as collateral and the uncertainty associated with innovation, traditional investors are hesitant to get involved (Molhova & Biolcheva, 2023). Along with the key risks of high failure rate of ECF-backed businesses, the long-term commitment and the lack of liquidity, stands the major issue of the valuation and the dilution of the purchased equity, inherently linked to the perspectives of the wanted positive outcomes by the investors – a successful exit or a public offering.

In such a high-risk context, determining the proper value of these companies could prove paramount, considering the profile of the majority of investors participating in such campaigns. A major issue here proves to be the limited due diligence process that the ECF platforms conduct when approving a campaign launch. Similarly to one of the biggest ECF platforms (Crowdcube), most of these service providers “do not set the valuation or provide an opinion on the valuation”, and the “decision on what valuation to offer is at the Company’s discretion”. Moreover, as with the valuation, the platforms “do not offer an opinion on the share price, which is set by the valuation”; the share price check is just to confirm that the share price has been accurately calculated from the valuation (Crowdcube Capital Ltd, 2023).

As part of their regulatory obligations, most ECF platforms clearly stress on that unlike listed companies that are valued publicly through market-driven stock prices, the valuation of startups can be difficult to determine and is often subjective. Another key problem to address is that the investor may risk overpaying for the equity stake he received (StartEngine Capital, 2024).

To outline the methodological process of conducting pre- and post- money valuations of equity crowdfunded companies, using AI in order to enable viable and feasible comparisons, leading to better and smarter investor decisions.

- Focus of research

The paper aims to explore the means offered by AI in terms of delivering feasible company valuations of ECF funded enterprises, such an approach being the main object of research. The subjects are the companies themselves, which can be classified as either a “Start-up” or “Later stage venture” in line with the specific stage of investment they are currently in (The European Data Cooperative (EDC), 2019).

Table 1. Investment stages in private equity

Source: Invest Europe research methodology and definitions (EDC, 2019)

| Stage of investment | Venture Capital Transactions | Seed | Funding provided before the investee company has started mass production/distribution with the aim to complete research, product definition or product design, also including market tests and creating prototypes. This funding will not be used to start mass production/distribution. |

| Start-up | Funding provided to companies, once the product or service is fully developed, to start mass production/distribution and to cover initial marketing. Companies may be in the process of being set up or may have been in business for a shorter time, but have not sold their product commercially yet. The destination of the capital would be mostly to cover capital expenditures and initial working capital.

This stage contains also the investments reported as “Other early stage” which represents funding provided to companies that have initiated commercial manufacturing but require further funds to cover additional capital expenditures and working capital before they reach the break-even point. They will not be generating a profit yet. |

||

| Later stage venture | Financing provided for an operating company, which may or may not be profitable. Late-stage venture tends to be financing into companies already backed by VCs. Typically, in C or D rounds. | ||

| Capital for mature companies Transactions | Growth capital | A type of private equity investment (often a minority investment) in relatively mature companies that are looking for primary capital to expand and improve operations or enter new markets to accelerate the growth of the business. | |

| Rescue / Turnaround | Financing made available to an existing business, which has experienced financial distress, with a view to re-establishing prosperity. | ||

| Replacement capital | Minority stake purchase from another private equity investment organisation or from another shareholder or shareholders. | ||

| Buyout | Financing provided to acquire a company. It may use a significant amount of borrowed capital to meet the cost of acquisition. Typically, by purchasing majority or controlling stakes. |

This notion of compliance with these two specific stages of investment is derived from yet another key issue for ECF investors – most of the companies who offer equity via such platforms are at this stage of their growth, and most of them remain there for a long time, typical for this period of growth of such ventures (Spinelli & Adams, 2012). The equity raised from mature companies is often more popular with these platforms (Ralcheva & Roosenboom, 2020).

Given the nature of these ventures, multiple challenges are to be overcome in the process of valuing a business entity in these stages, such as uncertainty of future performance, lack of suitable entities to compare, bias, subjectivity, etc. These challenges also provoke professionals and investors to use alternative methods to conduct such valuations, such as Cost-to-Duplicate, Market Multiple, Valuation by Stage and Discounted Cash Flow (DCF). The intrinsic features of these companies predetermine the lack or limited usage of most of the known and used valuation approaches and methods (Damodaran, 2009). However, the focus of research emphasizes on the companies which already have some viable financial data and have achieved (even limited) traction so far. Apropos, the research is limited to equity crowdfunded companies that have between operational between 3-10 years since their successful crowdfunding campaign. This is considered a suitable stage development period when an investor could expect some clarity if there would be any notions of an “exit” or options for liquidity provision (US Securities and Exchange Commission, 2024).

- Methodology

Conversing the characteristics of the subject companies, the paper utilizes the Discounted Cash Flow model as the main technique for conducting an AI-enhanced company valuation. As explained by Aswath Damodaran[2], in discounted cash flow valuation, the value of an asset is the present value of the expected cash flows on the asset. It is based on the presumption that every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth and risk. Since DCF valuation, done right, is based upon an asset’s fundamentals, it should be less exposed to market moods and perceptions. If good investors buy businesses, rather than stocks (the Warren Buffet adage), discounted cash flow valuation is the right way to think about what you are getting when you buy an asset. DCF valuation forces you to think about the underlying characteristics of the firm and understand its business. However, since it is an attempt to estimate intrinsic value, it requires far more explicit inputs and information than other valuation approaches. At the risk of stating the obvious, this approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It works best for investors who either: have a long time horizon, allowing the market time to correct its valuation mistakes and for price to revert to “true” value; or are capable of providing the catalyst needed to move price to value, as would be the case if you were an activist investor or a potential acquirer of the whole firm (Damodaran, 2012). These presumptions back the choice of the DCF model as one of the most suitable for valuing the companies subject to the current research. Moreover, the discussed intrinsic characteristics of the subject companies determine the sub-division of choice of the DCF model – Free Cash Flow to Equity (FCFE). Furthermore, the FCFE DCF model is often preferred as a tool to conduct valuations in banks and insurance companies (McKinsey, 2020). Given that most of these start-ups (especially in FinTech[3] and InsurTech[4]) often operate as such, it is arguable that this is one of the most appropriate models to consider.

The common approach to apply the DCF enterprise valuation model can be structured in 6 main steps (Nenkov & Hristozov, 2022):

– Step 1: Determine the expected operating free cash flows.

– Step 2: Determine the discount rate. (This is the WACC, because the valuation is at the invested capital level, and the discounted cash flows are to all investors.)

– Step 3: Determine the continuing (terminal) value (CV, TV).

– Step 4: Determine the operating value of the company.

– Step 5: Determine the value of the company as a whole.

– Step 6: Determine the value of equity and the value per share.

These steps are integrated as key milestones and conversation triggers in the suggested AI-enhanced approach for conducting the ECF-funded company valuations. In Step 2, the cost of equity is calculated via the Capital Asset Pricing Model (CAPM), a prominent and ubiquitous method for the task.

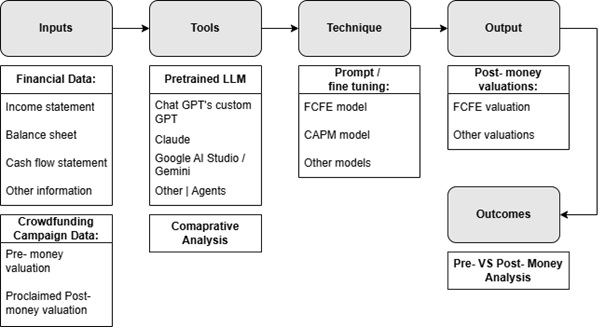

The methodological approach adapts the logical framework method (LFM) popular in project management (Baccarini, 1999) in the suggested process for utilizing the power of AI in conducting valuations for equity crowdfunded companies. This is done by defining the key inputs, tools and techniques, and outputs to be processed.

According to recent research, there are considerable efforts directed towards developing general purpose LLM[5] agents for sequential decision-making. Furthermore, researchers have started to exploit how LLM agents can perform better in harder decision-making tasks from finance (R. Yang et al., 2024). Numerous authors conclude that LLMs perform generative AI services with very high applicability for financial analysis and company valuation by automating data processing, enhancing sentiment analysis, and adapting to specialized financial knowledge. These capabilities make LLMs extremely useful tools for extracting insights and making data-driven decisions in the financial sector (Jeong, 2023; Kim et al., 2023; Yang, Xu & Qi, 2024).

- Application of the proposed methodology

For the practical application of the suggested framework approach, each of the steps in the DCF valuation is broken down to necessary inputs and further linked with prompts to complete the required tasks. Some of the prompts are introduced as conversation starters or triggers which enable the continuation of the valuation process. Figure 1 below depicts this process. Since the proposed approach considers performing a FCFE valuation (not a Free Cash Flow to Firm (FCFF)), the process’s steps are streamlined to reflect that, and steps are augmented. The main objectives of the described process are:

– To instruct the AI and enable its fine-tuning, so that it can execute the process of conducting valuations and comparisons.

– To guide the user through process prompting him for information and following steps.

– To enable the user to easily conduct such valuations and comparison analysis using publicly available financial information on the companies subject to the current research.

To achieve these, after each consecutive step several inputs are transformed into key outputs using appropriate tools and techniques. Then these outputs are integrated into the following steps of the process by prompting the AI respectively.

Figure 1. High-level overview of the process flow for conducting LLM-enhanced valuations of equity crowdfunded companies Source: Developed by the author

To test the proposed model, a Custom GPT[6] (named “Equity Crowdfunded Company Valuation Tool”) was trained on the ChatGPT platform, using the detailed process flow as described in Appendix 1[7] and fine-tuned with the Instructions as described in Appendix 2[8], both part of this paper. The GPT was set to have the following capabilities: DALL-E[9] Images; Browsing; Code Interpreter & Data Analysis, which enable the AI to assist the user with charting, browsing online for necessary benchmarking, etc.

- Case study – Valuation of Chip Financial Ltd using an AI-enhanced LFM

The GPT was used to conduct a FCFE valuation of Chip Financial Limited, a FinTech company, based in the UK, and funded via several rounds of successful equity crowdfunding campaigns on Crowdcube.

According to the company’s Strategic Report, Chip’s mission is to empower customers to build long-term wealth, offering market-leading savings, investment, and pension products through an easy-to-use mobile app. The vision is to provide the best tools and services for wealth-building to the UK’s aspiring mass affluent consumers.

Chip is not a traditional financial institution but a technology-driven platform that aggregates a range of curated financial services seamlessly. Leveraging cloud technology, Chip’s platform is built on core banking infrastructure provided by Clearbank[10] to offer a variety of FSCS-protected savings accounts, a cash ISA, a Stocks & Shares ISA and a general investment account. Features also include automated Saving Al, OpenBanking powered account information services, faster payments (FPS) and real-time product to product transfers.

Chip’s innovative business model does not require the company to hold customer balances, instead funds are transferred to regulated third party providers, deposit taking banks and asset managers. This approach empowers Chip to focus on the customer experience layer, ensuring the delivery of optimal customer outcomes, all while maintaining capital efficiency.

The business model requires Chip to own the customer experience whilst earning revenue through spreads or fees on placed deposits, subscription fees for premium features, and revenue from assets held with third-party banks and investment platforms.

5.1. Conducting the valuation

For conducting the valuation, several reports and financial documents were uploaded to the GPT, triggering the initially set-up steps. These contained information for the financial years 2022, 2023 and additional data, including information from the Income statements, Balance sheets and Cash flow statements of the company.

The GPT followed the pre-trained scenario and lead the user throughout the entire process, prompting for any requested information (such as the Risk-Free Rate (Rf), the Market Risk Premium (MRP), and the Beta (β), necessary to calculate the cost of equity using the CAPM model. During the whole process it provided the user with the option to use standard assumptions or typical industry values, which greatly enhanced the experience.

It followed the prescribed process and calculated the outputs for each step. The valuation concluded with the comparison of the initial pre-money valuation of the company, and the calculated FCFE valuation of the GPT.

5.2. Key insights

After a few iterations of prompting, the GPT provided a brief on-point Comparative Analysis, comparing the Low-End Pre-Money Valuation vs. FCFE Valuation and High-End Pre-Money Valuation vs. FCFE Valuation. Moreover, it was able to reflect on how this affects the investor decisions, offering insights on key aspects such as understanding the valuation drivers, risk assessment, investment strategy, due diligence, and decision-making.[11] The excerpt below (in grey) presents the summarized report of the GPT, regarding the conducted valuation.

- Free Cash Flow to Equity (FCFE) Valuation

The FCFE valuation is based on the company’s ability to generate free cash flow. This valuation method provides a conservative estimate of the company’s value. The FCFE calculated for Chip Financial Ltd. is approximately £15,108,037.

- Pre-Money Valuation Comparison

The pre-money valuation represents the estimated market value of the company prior to the latest round of funding. Chip Financial Ltd.’s pre-money valuation was set between £36 million (low-end) and £126 million (high-end).

- Analysis

The FCFE valuation is significantly lower than both the low-end and high-end pre-money valuations. This suggests that the pre-money valuation may incorporate growth expectations and market sentiment that are not reflected in the company’s current cash flows.

- Valuation Comparison Chart

Figure 2. ECF Startup Valuation Report - Chip Financial Ltd. Source: Equity Crowdfunded Company Valuation Tool (Custom GPT, developed by the author; ChatGPT 4o, 2024)

- Implications and future research

The modalities of the equity crowdfunding as a means to fund mainly starting business ventures, nurture significant research interest in its potential, issues and ways to further enhance its applications. Company valuations play a crucial part in such use cases. Considering the established logical framework method for conducting valuations leveraging AI and the presented pilot case study, a number of key insights can be highlighted as results from the current research effort:

– Several limitations are present, given that only one of many known valuation models was used to conduct the valuation in the case study. Given that LLMs can easily adopt the usage of several more models and even use an agentic approach to solving such a task (Guo et al., 2024), it is discussable that such valuations can be further adapted and enhanced to produce even more precise and valuable results using the full capabilities of what LLMs can and could do in the near future. However, the main purpose of the current paper is to establish the approach and streamline the process, not to achieve comprehensive results in such a direction. The application of other valuation models and especially via LLM-based Multi-Agent (LLM-MA) systems, provides viable future research perspectives.

– Given the wide adoption of GenAI across multiple sectors, it would be relatively easy to adjust the introduced LFM to conduct various types of valuations which can further enhance results and improve investor decision making. The study further establishes and outlines the value of integrating AI features into business management, which may result in added value for the business, and ultimately, for the investors, thus increasing both individual and corporate productivity and efficiency (Biolcheva & Sterev, 2024).

– The adoption of GenAI in the valuation process greatly increases productivity, speed and automation. It is undoubtedly an extremely fast and accessible approach to conduct such otherwise highly specialized and arguably expensive valuations. Moreover, such methods as the one introduced in this paper, exhibit prominence and potential in addressing the issue of passing by the entrepreneurial “valley of death” – a major issue, responsible for the business “deaths” of early-stage entrepreneurs, and may also add up to training and competence approaches in the pre-incubation stage (Sterev, 2023).

– However, the “Human-in-the-Loop” aspect of the valuation remains of utmost importance and must always be considered given the possibility of hallucinations on behalf of the LLM (Andersen & Maalej, 2023). This establishes the application of such LFMs more as an additional tool to be leveraged by investors and professionals alike, which can be utilized for more basic or ex-ante analysis. Serious investor decisions should still be backed by a professional and in-depth analysis, covering all major considerations regarding an investment.

– Nevertheless, such AI application proves to be a useful and robust enough tool to complement all kinds of analytical work related to investments. Its usage might greatly enhance the investor decision making, especially for the “retail” and “non-sophisticated” investors (European Parliament & Council of the European Union, 2020) in equity crowdfunding campaigns.

– The ease of access to such AI tools has the potential to be successfully implemented and leveraged by the service providers (the platforms) adding to their portfolio of services and enhancing user experience. This can greatly enhance the due diligence process and provide useful information for mature companies in one’s portfolio of ECF investments. Moreover, the integration of such tools can greatly nurture and influence the secondary market for equity from these companies.

– Conversely, such knowledge and insights might lower investor’s sentiment and expectations and endanger the success of the crowdfunding campaigns of many companies, respectively it might endanger the integrity of the whole equity crowdfunding industry.

It remains to be seen whether and how AI shall be adopted by the crowdfunding industry. Given that valuation plays a key role in investor decision making, one can argue that its adoption can be both beneficial and destructive. This establishes it as a pivotal discussion topic for further research.

Nevertheless, the discussion concerning the outcomes of conducting such valuations, can clearly benefit from the introduction of AI in the process, which can greatly increase the precision and speed of such studies, leading to more and enhanced positive outcomes for the investors and the companies, while minimizing the associated risks and negative outcomes for all the involved parties. One can argue that the involvement of widely available AI instruments (such as GenAI), along with other technological advances (such as blockchain / distributed ledger technologies), can lead to significant positive impacts for the equity crowdfunding niche, which have the potential to increase its application and wider adoption in other economic sectors.

REFERENCES

Andersen, J. S., & Maalej, W. (2023). Design Patterns for Machine Learning Based Systems with Human-in-the-Loop. https://doi.org/10.1109/XXX.0000.0000000

Baccarini, D. (1999). The Logical Framework Method for Defining Project Success. Project Management Journal, 30(4), 25–32. https://doi.org/10.1177/875697289903000405

Biolcheva, P., & Sterev, N. (2024). A Model for Calculating the Indirect Added Value of AI for Business. Strategies for Policy in Science and Education-Strategii Na Obrazovatelnata i Nauchnata Politika, 32(3s), 9–17. https://doi.org/10.53656/str2024-3s-1-mod

Cosma, S., & Rimo, G. (2024). Redefining insurance through technology: Achievements and perspectives in Insurtech. In Research in International Business and Finance (Vol. 70). Elsevier Ltd. https://doi.org/10.1016/j.ribaf.2024.102301

Crowdcube Capital Ltd. (2023, July). Due Diligence Charter. Crowdcube. https://www.crowdcube.com/explore/investing/due-diligence-charter.

Damodaran, A. (2009). Valuing Young, Start-up and Growth Companies: Estimation Issues and Valuation Challenges.

Damodaran, A. (2012). Tools and Techniques for Determining the Value of Any Asset. John Wiley & Sons, 666.

European Parliament, & Council of the European Union. (2020). Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European crowdfunding service providers for business, and amending Regulation (EU) 2017/1129 and Directive (EU) 2019/1937 (Text with EEA relevance). In Official Journal of the European Union: Vol. L 347 (pp. 1–49). https://eur-lex.europa.eu/legal-content/EN/TXT/?toc=OJ%3AL%3A2020%3A347%3ATOC&uri=uriserv%3AOJ.L_.2020.347.01.0001.01.ENG

Guo, T., Chen, X., Wang, Y., Chang, R., Pei, S., Chawla, N. V., Wiest, O., & Zhang, X. (2024). Large Language Model based Multi-Agents: A Survey of Progress and Challenges. http://arxiv.org/abs/2402.01680

Jeong, C. (2023). A Study on the Implementation of Generative AI Services Using an Enterprise Data-Based LLM Application Architecture. ArXiv.Org, abs/2309.01105. https://doi.org/10.48550/arxiv.2309.01105

Kim, S., Kim, S., Kim, Y., Park, J., Kim, S., Kim, M., Sung, C. H., Hong, J., & Lee, Y. (2023). LLMs Analyzing the Analysts: Do BERT and GPT Extract More Value from Financial Analyst Reports? Proceedings of the Fourth ACM International Conference on AI in Finance, 383–391. https://doi.org/10.1145/3604237.3627721

Li, B., & Xu, Z. (2021). Insights into financial technology (FinTech): a bibliometric and visual study. In Financial Innovation (Vol. 7, Issue 1). Springer Science and Business Media Deutschland GmbH. https://doi.org/10.1186/s40854-021-00285-7

McKinsey, M. G. D. W. (2020). Valuation: Measuring and Managing the Value of Companies (7th University Edition). John Wiley & Sons.

Molhova, M., & Biolcheva, P. (2023). STRATEGIES AND POLICIES TO SUPPORT THE DEVELOPMENT OF AI TECHNOLOGIES IN EUROPE. Strategies for Policy in Science and Education, 31(Number 3s). https://doi.org/10.53656/str2023-3s

Nenkov, D., & Hristozov, Y. (2022). DCF Valuation of Companies: Exploring the Interrelation Between Revenue and Operating Expenditures. Economic Alternatives, 28(4), 626–646. https://doi.org/10.37075/ea.2022.4.04

Ralcheva, A., & Roosenboom, P. (2020). Forecasting success in equity crowdfunding. Small Business Economics, 55(1), 39–56. https://doi.org/10.1007/s11187-019-00144-x

Spinelli, S., & Adams, R. (2012). NEW VENTURE CREATION: ENTREPRENEURSHIP FOR THE 21st CENTURY (9th edition). McGraw-Hill/Irwin.

StartEngine Capital. (2024). Investor Education Guide – Regulation Crowdfunding. Https://Help.Startengine.Com/Investor-Education-Guide-Regulation-Crowdfunding-R1LkCdCzY.

Sterev, N. (2023). PRE-INCUBATION TOOLKITS FOR ACADEMIC ENTREPRENEURSHIP FOSTERING: BULGARIAN CASE. Strategies for Policy in Science and Education, 31(Number 3s). https://doi.org/10.53656/str2023-3s

The European Data Cooperative (EDC). (2019). Invest Europe research methodology and definitions. Invest Europe. https://www.investeurope.eu/Research/about-Research/Methodology/.

US Securities and Exchange Commission. (2024). Exit Strategies and Liquidity. Https://Www.Sec.Gov/Resources-Small-Businesses/Capital-Raising-Building-Blocks/Exit-Strategies-Liquidity.

Yang, C., Xu, C., & Qi, Y. (2024). Financial Knowledge Large Language Model. https://doi.org/10.48550/arxiv.2407.00365

Yang, R., Yao, Z., Li, H., Deng, Z., Cao, Y., Chen, H., Suchow, J. W., Zhang, L., Cui, Z., Zhang, D., Subbalakshmi, K. P., Xiong, G., He, Y., Huang, J., Dong, L., & Xie, Q. (2024). FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making. https://doi.org/10.48550/arxiv.2407.06567

––––

[1] Source: Crowdcube: https://www.crowdcube.com/explore/blog/investing/equity-crowdfunding-101

[2] Source: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/Inv3ed.htm

[3] An abbreviation for financial technology, as an emerging technical term (Li & Xu, 2021)

[4] The application of technology to the traditional insurance business takes the name of Insurtech, a new term born from the merger of Insurance and Technology (Cosma & Rimo, 2024)

[5] An abbreviation for Large Language Model

[6] Custom GPT refers to a specialized variant of the Generative Pre-trained Transformer model, fine-tuned or trained with domain-specific data or configurations to improve performance on targeted applications, thus enhancing its utility in specialized contexts while preserving its general language processing capabilities. Description generated using ChatGPT 4o, 2024.

[7] Link to Appendix 1: https://tinyurl.com/56mxpyjw

[8] Link to Appendix 2: https://tinyurl.com/h4sdhn52

[9] A neural network that creates images from text captions for a wide range of concepts expressible in natural language. Source: https://openai.com/index/dall-e/

[10] Source: https://clear.bank/

[11] Source: ChatGPT. (n.d.). (2024). FCFE Valuation Request.